|

| :: October 2014 | Newsletter n°74 :: |

|

The European InstitutionsIn the last Newsletter (Issue 73, June 2014), we presented the result of the European Election

and the chart of their likely breakdown among the political groups. The

final repartition between groups was only marginally different and can

be found here. Election

and the chart of their likely breakdown among the political groups. The

final repartition between groups was only marginally different and can

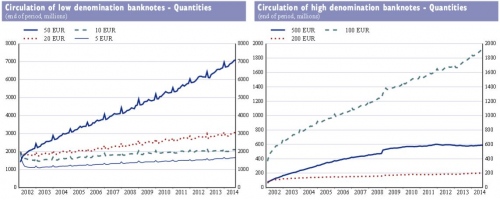

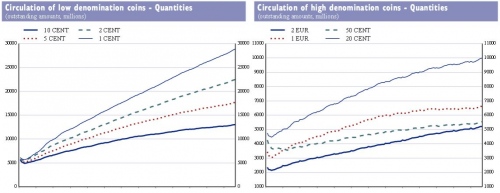

be found here. The first test of the new Parliament will be the election of the proposed college for the Junker Commission presented by the President- elect to the Council. The college still counts 28 Commissioners (one per country) contrary to the provision of the Lisbon Treaty which proposed a reduction to 14 Commissioners. However, for the first time ever, a hierarchical structure has been put in place with the team, with an effective deputy president (the Dutch “First Vice President” Frans Timmermans). The Commission work will be organized around “priority projects” lead by 6 Vice presidents to whom the other Commissioners will report. The commission was presented as a “strong team”, with 5 former Prime ministers and 19 former ministers. Only 7 Members of the Barroso Commission remain in the new College, including the German Öttinger, the Austrian Hahn, and the Finn Katainen (who only joined the Commission in July 2014 to replace Olli Rehn). The objective of the Junker commission will be to be: “bigger and more ambitious on big things, and smaller and more modest on small things”. A strong emphasis is given on better Regulation and Junker has promised a bond fire of “unnecessary” legislative proposals currently in the pipeline.Of specific relevance to ESTA are in particular: • VP for the Euro and social dialogue: Valdis Dombrovskis (Latvia), • Internal Market and Industry, entrepreuneurship and SMEs: VP Andrus Ansip (Estonia) and Elzebieta Bienkowska (Poland) specifically responsible for internal market; • Employment social affairs and labour mobility: Larianne Thyseen (Belgium) The list of Commissioners with their portfolios can be found here Hearing of the new Commission in their relevant Parliamentary Committees has taken place early in October 2014. The EP will then vote on the entire College (the Parliament can only accept or reject the college as a whole). Commission work on 1&2c € coinsThe commission (DG ECFIN) has invited ESTA and a number of other organizations (EVA, Scan Coin) together with NCBs and the ECB for a meeting to discuss the issue of the future of 1 and 2 cents coins, further to an impact assessment study conducted by the Mint group in relation to their continuation, particularly envisaging their issuance at a lower cost. Two members of ESTA’s Cash Group joined the meeting: Prosegur and BDGW.These coins represent 46 to 47% of all coins in circulation, yet a small portion of the total value of coins. A number of Member States have voiced their preference for an elimination of these coins, though the Commission assured the audience that no such proposal is on the table for the moment and the purpose of the meeting was to assess to reduce their cost, not to discuss whether they should go or not. The discussion took place on the basis of a study prepare by Austria Mint. During the discussion, all options which would have as a consequence a change of size, weight and/or conductivity of coins which would affect the operation of either sorting and vending machines were generally opposed by the industry. The meeting did not aim to be conclusive and therefore no decision was adopted. Based on the discussion, the Mint Group will update its study on cost reduction possibilities. The main outcome of the meeting was that the emphasis, stressed notably by ESTA, has shifted from a mere production costs to a full life cycle assessment of these coins, including transportation, shelf life, coins management and processing, which should be reflected in the next version of the study. Cash use continues to represent a major part of all payments.Young people and cashIt is well known that one should not believe everything that can be read in papers. This principle found a new illustration in August when a survey in the US revealed that a slight majority (51%) of adult American up to the age of 30 preferred using cards for payments as low as $5. The conclusion drawn from the survey is that the American society is moving from cash to cards. The fact that the survey was commissioned by CreditCards.com probably explains the self-serving outcome of the survey.The Federal reserve however in its June study “Consumer Preference and the Use of Cash” showed the contrary: young people are more likely to use cash. 1According to the report, 40% of 18–24 year olds prefer cash to other payment methods, compared to only 25% of people aged 65 and over. Cash use and cards competitionThe research from the Federal Reserved mentioned earlier showed that cash is half of the payment in the US: it shows that card transactions still outnumbered cards payments, and nearly 60% of payment of less than $25 are made in cash (2012).A research in the UK2 confirms the same kind of findings: cash represents 53 %of retails payment in 2013. There are further interesting findings in this research: the survey shows that cash transactions only represented 9% of transaction costs by retailers (compared to a massive 85% of their transaction costs from the 42% card transactions). The number of cards in use is growing rapidly with an expected 10.8 billion cards in circulation worldwide at the end of 2013, with an increase of 11% compared to 20123. The number of cards is expected to continue to grow and the potential for it remains high. It shows however that the growth of cards is not taking place at the detriment of cash, as the total number of payments also increases in most countries (the UK being possibly an exception). 1Although some methodological bias may also explain the result obtained by the CreditCard.com survey, not least that its research only interviewed card owners, when the Fed surveyed a representative sample of young people: see “Young American Hate Cash… or do they ?”Currency News Volume 12 – Issue 9 of September 2014 2British Retail Consortium, Retail Payment Survey 2013 3Global Payments Cards Data Forecasts : 2013-2019, Currency News August 2014A French Tax Payer Pays taxes in 1,2 and 5 cents coins.

The French news reported on 16 September that a taxpayer, who was denied

delay to pay her 1200 euros of annual income tax, has paid as a

protest the last part of her tax bill (207 euros) in cash at the desk

using only 1, 2 and 5 cents coins. She came with bags totalizing 38

kilogrammes and it took reportedly a couple of hours for 7 officials to

count the coins and check the amount. The anecdote has it that they

were not happy. |

|

ESTA - European Security Transport Association Rond Point Schuman 6 - B5, Brussels, 1040, Belgium Tel: +32(0)2 234 78 20 www.esta-cash.eu, contact@esta-cash.eu |

June 2nd 2015. The hotel located on the Friedrichstrasse is very

central and close to the Unter den Linden and the Branderburger Tor.

June 2nd 2015. The hotel located on the Friedrichstrasse is very

central and close to the Unter den Linden and the Branderburger Tor.