ESTA Conference Athens, Greece, 1-3 June 2014

Limited number of rooms at conference venue Divani Caravel Hotel (5

star). Special deal with the hotel only lasts till 31 March.

Paul Hughes, 10 Meters of Thinking - Professional Moderator

10 meters of thinking will get us started at the conference. With a

visual and oral experience on paper, Paul Hughes will unravel the

meaning of innovation. Through diagrams and storytelling he will analyse

the past, clarify our present and take us through actively creating the

future we want by innovation.

tenmetersofthinking.com

CIT Solutions and Panel Discussion

Our focus on Day 1 of the conference will be CIT solutions and discussion with the audience, moderated by Paul Hughes.

Nokas & ATMs - Kjetil Ellestad

Prosegur services for Banks - Achim Boers

Brink’s Automated cashier positions for major retailers - Patrice Moreau

G4S – Innovations in the Greek cash market - Alistair Fowler-Marson

COOP innovations with Loomis - Anders Jonasson

Security - What works

Day 2 of the conference is about the security successes of our members. Moderating will be Tony Smillie and the speakers are:

Prosegur: Foam in trucks – Achim Boers

Loomis: Fishnet in cash centres – Mikael Hanson

Brink’s: Fog in cash centres - François Lagniez

G4S: Tracking devices in cassettes – Andy Cruikshank

Insurance Panel

This year a panel discussion will be the format for a lively discussion on our insurance issues:

• Why are premiums so high?

• Understanding our business

• Shared Punishment: why does a loss to one operator mean I pay a higher premium?

• Insurance cover: why can every operator - good or bad - obtain terms?

• Physical cash vs non-physical cover

• Cyber cover and cyber exclusions

• Owners fraud exclusions vs reality

Tony Smillie, Chair of ESTA Security Working Group is the moderator, and

underwriters and brokers will be represented on the panel by: Philip

Turner, Neal Watson, Jason Kyd and Joshila Taylor.

ESTA News

New Vision statement for ESTA

ESTA’s Board of Directors decided last month to re-visit the ESTA vision

statement. Our new vision, recently published on the website is this:

ESTA is the European association of Cash Management companies. Our

vision is to be the recognized voice of the industry ensuring that cash

is safe, reliable, available and the most efficient means of payment.

Read more

New Working Group: Communications

A new working group is being created: Communications. The aim of this

group will be to develop a new and pro-active strategy for ESTA’s

communication and image.

ECB News

Card fraud increased in 2012

• €1 in every €2,635 spent on credit and debit cards was lost to fraud

• There are more fraudulent internet transactions, in line with the strong growth of online sales

• Industry should continue enhancing security features, in particular for online sales

Read more Third report on card fraud, by ECB

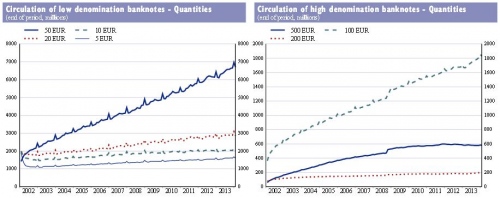

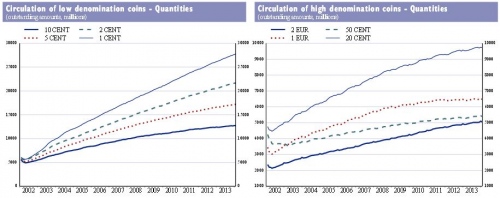

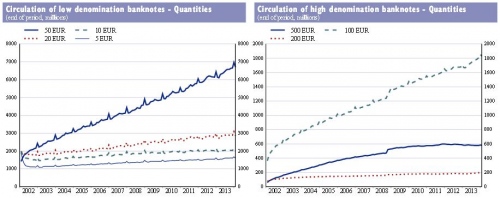

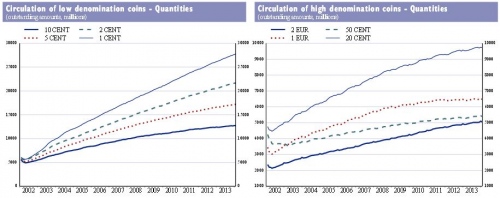

Cash in circulation (ECB)

This is the latest information published by the European Central Bank showing cash in circulation.

The total number of Euro banknotes in circulation in 2012 stood at

15,687 million, with a value of €912.6 billion, an increase of 4.9% in

volume and an increase of 2.7% in value since 2011. Between 2012 and the

end of 2013, there was another increase of 5.25% in volume and an

increase of 4.7% in value.

In 2012 the total number of Euro coins in circulation grew to 102,032

million, and their value increased to €23,658 million, an increase of

4.3% and 2.5% respectively since 2011. Comparing 2012 with 2013 there

was an increase of 3.8% in volume and 2.3% in value.

Click on graph to access detailed info on low and high denomination banknotes and coins

.

Source: European Central Bank

From the Media

Competition for new customers drives growth in European cards market

According to RBR’s report “Payment Cards Issuing and Acquiring Europe

2014”, there was a 20% rise in the number of cards in circulation

between 2008 and 2012 (to reach 1.4 billion) and a 40% increase in

payments over the same period, as consumers used their cards more

frequently for everyday purchases. Central and eastern Europe (CEE)

accounted for two thirds of new cards across the region between 2008 and

2012, with the number of cards in Russia alone doubling to 240 million.

The RBR survey predicts that the European cards market will continue to

grow, even in the face of newer payment methods such as contactless

cards, for several years to come.

Source: RBR,

www.rbrlondon.com

Commercial cards held back by economic uncertainty

42 million commercial cards were in issue in the 15 largest markets in

Europe at the end of 2012, up 9% since 2010. However, RBR forecasts the

number of cards to rise at a modest 4% per year between 2012 and 2018

due to concerns over employee spending and economic uncertainty.

Debit and prepaid sectors set to grow

Debit and prepaid cards, which currently represent 19% and 1% of the

commercial cards sector respectively, are expected to become more

common, as businesses regard them as a means to reduce costs and control

employee spending.

Source:

www.rbrlondon.com/reports/commercialcards

Asia leads the way as growth in global ATM market accelerates

The number of ATMs installed worldwide increased by more than 180,000

during 2012 to reach 2.6 million at the end of the year. The global

market grew faster in 2012 than in either 2011 or 2010.

Western Europe and North America have both seen slower growth in recent

years as markets in those regions have matured. Source: RBR,

www.rbrlondon.com

Cross-border payment behaviour of Dutch consumers 2012

A DNB survey shows that the Dutch frequently use their debit cards, also

when abroad. The debit card tends to be the preferred means of payment

at fuelling stations, in supermarkets, for accommodation and for larger

purchases generally. In many other situations, however, cash is still

used most frequently.

Source:

Cross-border payment behaviour of Dutch consumers 2012, published by the De Nederlandsche Bank

Cash Management and Payment Choices: A Simulation Model with International Comparisons

Despite various payment innovations, today, cash is still heavily used

to pay for low-value purchases. The De Nederlandsche Bank paper tests

the assumption that cash is still the most efficient payment instrument,

and the idea that people hold cash for precautionary reasons when

facing uncertainty about their future purchases.

Source: De Nederlandsche Bank,

www.dnb.nl

Loss of free banking - banking behaviour changed

In their market research findings from February 2014 ”Banking &

Consumer Behaviour”, the Ireland National Consumer Agency shows that 34%

of current account holders have had their “free” banking withdrawn in

the past 12 months.

The key behavioural changes from losing free banking are: taking out

more cash on each withdrawal (28%), using debit cards less often (25%)

and using credit cards more for routine transactions (13%).

Source:

www.consumerhelp.ie

Many thanks to ESTA's exhibitors and sponsors of the 2014 conference in Athens, Greece, 1-3 June.

Sponsors

|

|

|

Conference Organizer: European Security Transport Association, ESTA

www.esta-cash.eu, Rowena Judd:

rowena@esta.biz