| ||||

| :: June 2014 | Newsletter n°73 :: | ||||

|

||||

Key points - Athens Conference 1-3 June 2013The continuous success of ESTA’s annual conference was proven again in Athens with more than 220 participants and 40 spouses joining from a large array of businesses from the cash industry. Innovation was the focus of this year’s conference, the first under the aegis of ESTA’s new President, Jarl Dahlfors, CEO Loomis.

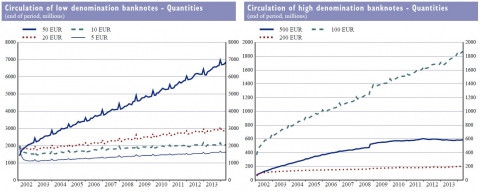

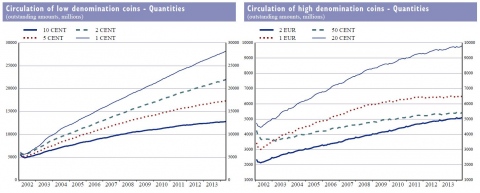

In the audience, there were probably a large number of fans of ABBA, the renowned pop group of the late 70s and 80s, however few had expected that ABBA would be the focus of Jarl’s introductory note to the conference, pointing out their MasterCard-sponsored new museum not allowing for entry ticket to be paid in cash. ABBA would surely take interest in Jarl’s comments drawn from data of the US Federal Reserve that consumers of all age groups do use cash more frequently than any other of payment. Jarl also presented the new vision of ESTA and the emphasis given on external communication and its role in being the voice of the cash industry, focused on cash solutions and management, not just transport. EU AffairsThe topic was covered by two presentations of the ECB and the European Commission. Ton Roos, Director Banknotes at the ECB, informed the audience of developments in three areas of work of the ECB: the CIT/CMC study, the work towards greater convergence between NCB cash services and the IBNS study. Concerning the CIT/CMC study, he invited companies to participate in the work and to respond to interview requests so as to provide the most accurate understanding of the functioning and business environment of the cash industry.Rüdiger Voss, head of section Euro cash and legal issues in the European Commission, covered the forthcoming revision of the CIT regulation, which should be launched in 2016. Of particular interest are the very few number of cross-border licenses requested so far (12 in 5 Member states – half of which are from Germany) since the entry into force of the Regulation. The reasons for this are various and range from natural limitations (such as language, unwillingness to use cross border services, fragmented legal systems etc.) to obstacles such as rules on fire arms or armoured vehicles. Social/labour environment is also responsible in his view for the limited development of cross border provision of services. The second topic concerned the use of cash and the current debates going on at EU level on whether hard law is needed for ensuring legal tender of cash, issues pertaining to small cash (rounding up, 1 and 2 cents coins) and high denominations. The Commission also showed some interest in existing limits on cash payments imposed by a number of Member States, ranging from €1,000 to €15,000. InnovationThis was this year’s theme of the annual conference. The first session of the conference was initiated by Paul Hughes and his “10 meters of thinking”, an invitation to think outside the box and to do things differently. Whether participants liked it (most of them) or not (as a few said), the presentation did not leave anyone in the audience indifferent.Concrete illustrations of innovation in the industry were showcased during the conference. Kjetil Ellestad presented Nokas’ ATMs network which it operates both with its own ATMs and those of banks and highlighted the company’s value proposition for banks, customers and Nokas & its partners. Achim Boers, from Prosegur, presented the outsourcing solutions offered by multi-agency for banks and retailers. Patrice Moreau, from Brink’s, developed new automation processes allowing substantial optimisation of the cash processes, reduction of risks and of costs. Alistair Fowler-Marson took the conference through a case study where a tobacco company had to comprehensively re-engineer its retailers’ network in Greece while improving efficiency, security and cash flow. Finally, Anders Jonasson of COOP explained how the high level of robbery affecting their retailers could be efficiently addressed together with Loomis through closed checkout systems and their ability to amortise the investment over a three year timeframe. Attacks and loss reportLast year’s downward trend for robberies in our industry was confirmed during this year’s presentation of Tony Smillie, who shared good news, the first being the sharp reduction of the number of attacks (-25%) and the commensurate decrease of the loss (including of average loss) resulting from these attacks. Also of note in the increasing number of failed attacks.Insurance panelAn insurance panel was organised between brokers and underwriters with Neil Watson (Willis), James McNaughton (Ascot), Jason Kyd (GAIC) and Philip Turner (Marsh) sharing the floor. Topics of a lively debate focused on the level of risk and how it was reflected in the level of premiums – the good news being that the reduction of losses should be reflected in future premiums. Whilst the insurance sector is very competitive, the level of premiums offered by all companies also reflect the losses suffered by a few in the light of keeping a balanced system (though underwriters were keen to emphasise that recovery of loss for each individual company would take place over a number of years). Also of interest to the audience was the discussion over exclusions from coverage (e.g. cyber exclusion, infidelity risk etc.) where brokers advised to pay attention to the wording of the exclusion clauses in contracts; they also advised checking with them for alternative language for these exclusions which they can provide and to keep in mind that exclusion of specific risks should be reflected in the reduction of premiums, notably for risk such as owner’s fraud.What works: cash management solutionsThe last session of the conference was devoted to reviewing proven technologies and developments of relevance to the industry. Andrzej Momot (Prosegur) talked about the technology of foam in trucks, a combination of chemicals being flooded in the van in case of attack and creating a thick and rapidly solidifying foam, the aim of which is to increase substantially the time needed for criminals to access the cash. Mikael Hanson (Loomis) explained the development of fishnet in cash centres to reduce the effectiveness of the use of explosives to access the premises. Brink’s François Lagniez showed how the development of fog and strobes in cash centres can be an effective protection against attacks. Finally, Andy Cruickshank, G4S, spoke about the effectiveness of tracking devices in protection boxes and how it increases the chances of being caught for criminals whilst reducing the amount of loss.The presentations delivered at this conference are available at ESTA web site ECB NewsCash in circulation (ECB)This is the latest information published by the European Central Bank showing cash in circulation.The total number of Euro banknotes in circulation at the end of May 2014 stood at 16,275 million, with a value of €957.7 billion, a drop of 1.3% in volume and a slight increase of 0.1% in value since Q4 2013, whereas between Q3 2013 and the end of Q4 2013, there was an important increase of 5.5% in volume and a 4% in value. End of May this year the total number of Euro coins in circulation grew to 107,716 million, with a value of €24,379 million, an increase of 1.6% and 0.7% respectively since Q4 2013. Comparing Q3 with Q4 in 2013 there was a slight increase of 0.9% in volume and a 0.9% in value. Click on graph to access detailed info on low and high denomination banknotes and coins.

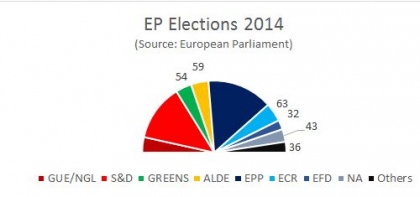

The European Parliament electionsThe new Parliament was elected on 22-25 June 2014. The 8th term of the European Parliament now counts 751 Members of the European Parliament (MEPs), compared to 766 outgoing MEPs, from 28 Member States. As in the previous House, the Conservative group (EPP) is the largest group with 221 members, followed by the Socialists (S&D, 191 Members)*, although the share of the EPP group has reduced from 36% to 29.5% and the S&D group remaining stable at 25.4%. Of interest in the new Parliament is the large number of Europhobic/Eurosceptic MEPs – around 180 MEPs in total, of which a larger number of them belonging to far right parties MEPs than ever before: the question of whether the latter will be able to join forces and form a political group is still pending: whilst the minimum number of MEPs required (25) is undoubtedly going to be met, Marine Le Pen was still struggling to find a minimum of 7 nationalities needed for a political group. Forming a political group provides MEPs much more power and influence than if they remain as non-affiliated (NA). As things stand at the time of writing the Newsletter, it was not clear whether the ALDE (liberals) or the ECR (eurosceptics) were the third largest group: the ranking of groups is also important as it determines speaking time for each political group. The next step will be for the EP to elect its President during the first session in July: it is expected that the German Socialist Martin Schultz will not be re-appointed (he is candidate to succeed José Manuel Barroso as president of the Commission) and that a Conservative will take over (according to an unwritten rule that Conservatives and Socialists alternatively share the EP presidency for half terms).  The other important task of the EP will be to vote in the new President-elect of the Commission proposed by the European Council. The absolute majority (376 votes) is required and it is not yet clear whether the EPP group will be able to find a majority to support their candidate. The outcome is very uncertain since the EPP candidate, the former head of the Euro Group Jean-Claude Junker, is fiercely opposed by the UK (although unanimity in the Council is no longer required for the appointment of the President-elect), the votes of whom may be critically missing in the EP. Considering the outcome of the elections, it will be very challenging to find any absolute majority which would not include the two main groups, the EPP and the S&D: the final vote on the president should therefore be the outcome of some consensus.  * Note that the effective numbers of MEPs in each EP political group is based on assumptions on where MEPs of specific national parties will want to seat.ESTA NewsESTA’s Secretary GeneralJarl Dahlfors, President of ESTA, announced during the Gala Dinner that Francis Ravez, current Secretary General of ESTA would be stepping down after ten years at his post. His replacement will be Thierry Lebeaux, who started his career in the European Commission (where he worked for seven years ) and who worked for more than 20 years as a consultant and corporate public affairs practitioner. The hand over will take place over the next couple of months and Francis will remain with us, gradually stepping down at the next Annual Conference in Germany.New MembersOur new ESTA members for this year are:• New adherent members : CTS (Italy), Inter-Hannover (Sweden) • New Effective member: Konsalnet (Romania)  ESTA conference 2015Next year's conference will be held in Germany (either Berlin or Munich) on May 31st to June 2nd 2015. Pencil in the date!Wishing you, and all your teams, a sunny and enjoyable summer. |

||||

|

ESTA - European Security Transport Association Rond Point Schuman 6 - B5, Brussels, 1040, Belgium Tel: +32(0)2 234 78 20 www.esta-cash.eu, contact@esta-cash.eu |