The European Institutions

Conference on the future of retail payments and consumer

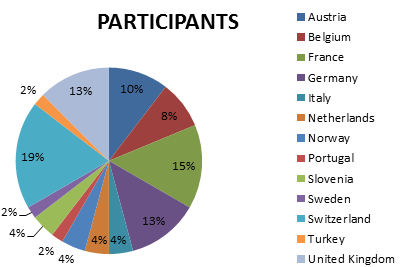

Over 300 applications were received to participate in the conference,

and 200 persons were selected by the Commission to join. The conference

covered four topics (simpler financial services products, behavioral

economics, mortgage credit and payments), followed by break-out sessions

on each of the topics. ESTA anticipated in the Conference’s fourth

group dealing with payments.

The introduction was made by

Lord Hill, Commissioner for Internal Market

who’s key message was that the internal market for financial services

simply does not work – he used the example of cross border insurance or

credit which is simply not possible. His approach focused around a few

principles, two of which are highly relevant to the cash industry:

• Strong belief in competition: it provides choice for

consumers, better service at lower prices and new operators other than

the “established” players in each market.

• Transparency: consumers need to understand what they are buying: are

they buying the best service for them or the one that brings the best

mark up for the seller. “Transparency is vital for an equitable balance

of power between producer and consumer”.

However, technology is changing the way market works and

more and more online trading takes place, up to online banking which is

changing the retail banking market. When considering electronic

financial services, the issue is the balance between protection against

fraud, hackers and money laundering and maintaining ease of use for

customers. Security is paramount; it is an essential element of any

financial services policy, but it should accompany, not prevent

innovation and development. The challenges are to

“increase transparency, reduce complexity, increase competition, and innovation.”

The key points that came out of the discussion on payments are:

• Future is seen in mobile payments but cash will remain

and cheques will go. Mobile payment will have to overcome security and

safety issues as well as privacy concerns.

• Mobile payments however are likely to be limited to B2C.

• Trust, convenience and security are key to the development of payment

systems, with instant payment a critical development needed,

particularly at cross border level.

• Key issue for the cost of payment is that payment infrastructure has

to be maintained and paid for. Future changes are likely to focus on

access channels rather than payments means per se; with some concerns

that global infrastructures currently existing are not European.

• The Commission state that “most participants felt that a good mix

between regulation, standards and market forces is needed to move the

European Payment Market one step further”. However, a number of

participants expressed the views that with regards to regulation,

improvement can probably be achieved through proper enforcement of

existing legislation as source of more efficient payment systems rather

than new regulation.

The final report and the conference documents can be found

here:

Seminar of information on the forthcoming introduction of the ES2 €20

The

European Central Bank organized a Seminar of information on the

forthcoming introduction of the ES2 €20 note in Rome on 6 February. As

an introduction of the event, some facts on cash were recalled:

• the volume and value of Euro notes in circulation since

its introduction has steadily increased to reach 17.5 bn notes in

circulation of a value of € 1016 bn in December 2014.

• 33 bn notes are processed each year by the Eurosyste m. On average, notes are processed three times per year.

m. On average, notes are processed three times per year.

• Hoarding notes grow faster than transaction notes (where the €50 is both hoarding and transaction note).

• The number of counterfeit remains very low, with roughly 51 fakes per

million (if any fake was allowed to circulate for a full year, although

on average they are detected within 2 weeks).

Some feedback was given on the launches of the previous two series ES2 €5 and ES2 €10 notes which were not

“as smooth as expected”,

with significant differences and successes reported in the various

Member States of the Eurozone. Lessons learned from the launch or the €5

euros proved useful for the introduction of the new €10 euros in 2014.

Particularly, allowing more time, from 3.5 to 8 months, for ensuring

readiness of operators proved critically important, whilst borrowing was

made easier and penalties were lowered.

The introduction of the new ES2 €20 note will take this feedback into

consideration. The challenges is by no means less as the €20 notes is

quite often tested for authentication at retailers, which is rarely the

case of €10 and virtually never the case of the €5 notes.

Since 45% of €20 notes are introduced via ATMs, penetration should however be quicker.

Key dates of the introduction of the ES2 €20 are the following:

• 24.02.2015: release of the new banknote to the general public;

• 25.02.2015: loans of new €20 notes to stakeholders from different banknote production

• 25.11.2015: official launch of the new series note, i.e. allowing for 9 months of preparation.

In the discussion with stakeholders during the Seminar, a

number of concerns were expressed from the floor in relation to the high

cost of adaptation of machines to the new notes, some operators

suggesting that the launch of several denominations at the same time

would reduce the cost. The ECB said that this was envisaged, however not

feasible for the €20 and €50 due to the very large numbers of notes,

but ECB said it would consider this for the subsequent launches of the

€100, €200 and €500.

Also of some concern to a number of operators was the need to have a

larger number of notes available ahead of the launch and the possibility

of considering a different period of the year for the launch, as end of

November puts additional pressure on operators due to the end of year

high demand for cash.

The ECB has put in place a “partnership programme” for

assisting operators in the introduction of the new notes and providing

educational tools and material. More information on the programme and

registration as a partner can be gathered on the

ECB’s web site

Cash is seen as the most secure means of payment

We reported in our last issue that cash continues to represent the largest part of all payments.

A new survey by Compass Plus, an international provider of retail

banking and electronic software has revealed that consumer trust in

newer payments methods has substantially decreased in 2014 compared to

2013. No less than 71.3% of all 670 respondents (in the UK) considered

that mobile payments are the least secure, nearly twice as much as the

proportion of respondents thinks the same in 2013 (38%).

Lack of confidence in the security of contact less payments also increased from 41 % in 2013 to nearly 47 in 2014.

Cash was seen for the third consecutive year of the survey as the most

secure means of payment (72.6%). According to the survey, confidence in

credit and debit cards also increased for both high street and internet

payment over the last year.

According to the author of the survey, the research shows that consumers enjoy the diversity of payment methods.

ECB News

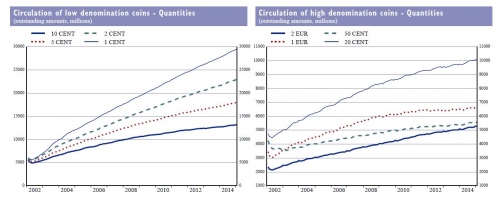

Cash in circulation (ECB)

This is the latest information published by the European Central Bank showing cash in circulation.

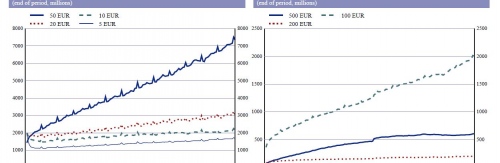

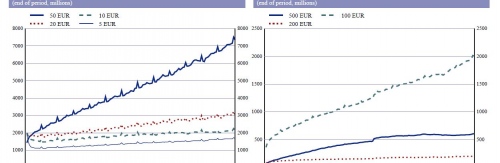

The total number of Euro banknotes in circulation at the end of January

2015 stood at 17,019 million, with a value of €1003.8 billion, a

decrease of nearly 3% in their quantity, but virtually no change in

value compared to December 2014.

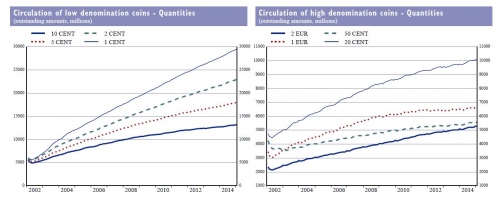

The total number of Euro coins in circulation end of January 2015

reduced from 110,922 million to 110,878 million, while their value

decreased from €25,003 million to €24,904 million, ie a decrease of

1.3% in value compared to December 2014.

Click on graph to access detailed info on low and high denomination banknotes and coins.

Banknotes

Euro coins

Euro coins

New Members

New ESTA members are:

ITW Envopak (UK)

Bütler Keystone Consulting (Switzerland)

ESTA conference 2015, Berlin May 31st-June 2nd

The 2015 year's conference programme is taking shape with a strong focus

on panel discussions to confront ideas and views of a large number of

operators from the cash market. A first panel will look at the role and

place of cash in an evolving payment market and confront the cash’s

incredible resilience in an environment of a fast changing payments

markets and concerns for security of payments.

Another panel will look the

evolving business model of Cash management companies.

Whilst there is a substantial potential for growth of the commercial

recycling of bank notes, particularly in the Eurozone, is the CMC

industry ready to catch it? What would it need to do to take a bigger

share of the recycling? Does it imply revisiting its business model and

if so, what is the path the CMC industry should be considering? The

debate will involve both suppliers and clients organization of the

market.

Making cash availability to consumer is essential to

the cash market and ATMs play a central role for that. However, the ATM

market is going through structural changes in a number of countries. The

ESTA 2015 conference will analyze these changes and confront them to

consumers’ needs and preferences.

There are important lessons to be learned from this

year’s Attack and Loss presentation. The presentation will go deeper in

analysing attacks trends and review a few attacks of 2014 into case

studies.

Last year’s insurance panel also touched on the sensitive issue of

internal losses. This year’s conference will report on ESTA’s own work

on internal losses and preparation of a White Paper, and the insurance

panel will be devoted to the issue.

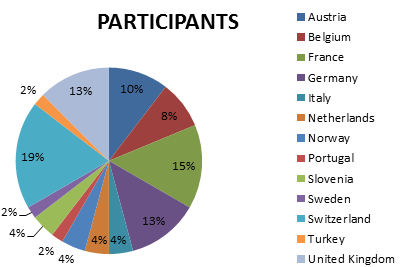

Registration and Exhibition

As for previous years, the pace of registration is increasing fast and

attendance to this year’s conference in Berlin is likely to reach record

attendance!

Contact us to discuss exhibition and sponsorship options:

contact@esta.biz

Accommodation

Book your accommodation early and secure a room at the Conference hotel

the Maritim Pro-Arte as that area around the Brandenburger Tor area is

particularly nice. Benefit from ESTA rates

here.

Looking forward to welcoming you in Berlin!

The

European Central Bank organized a Seminar of information on the

forthcoming introduction of the ES2 €20 note in Rome on 6 February. As

an introduction of the event, some facts on cash were recalled:

The

European Central Bank organized a Seminar of information on the

forthcoming introduction of the ES2 €20 note in Rome on 6 February. As

an introduction of the event, some facts on cash were recalled:  m. On average, notes are processed three times per year.

m. On average, notes are processed three times per year.