| ||||

| :: October 2015 | Newsletter n°76 :: | ||||

|

||||

|

|

|

Kenneth Högman, ESTA President since September

|

Kenneth Högman has been in the industry for more than 30 years and on

the ESTA Board for 6 years. Alongside chairing the Cash group he has

worked with various ESTA projects.

Kenneth has vast industry experience from global positions in Loomis as

well as local "basic" cash experience from being directly responsible

for operations in countries.

Kenneth is part of the Group Management team in Loomis and currently holds the position as Regional President Northern Europe.

The Board of ESTA is composed of the following Members

|

ESTA’s annual conference in Berlin, May 31st - June 2nd 2015

Around

280 professionals from the Cash industry gathered in Berlin for the

31st annual conference to debate on the topic of the Changing Cash

Market. This number represented a considerable increase of attendance

compared to the 2014 conference in Athens.

Around

280 professionals from the Cash industry gathered in Berlin for the

31st annual conference to debate on the topic of the Changing Cash

Market. This number represented a considerable increase of attendance

compared to the 2014 conference in Athens.

The audience enjoyed lively panel debates such as the one between

Norbert Bielefeld, of the ESBG and Guillaume Lepecq, of AGIS on cash use

and the future of cash or the stimulating debate between insurance

brokers and underwriters on the sensitive issue of internal loss. New

horizons in relation to the CIT/CMC business model were explored and

challenging views  and options were debated during the various sessions.

and options were debated during the various sessions.

The Gala dinner took place in the exceptional site of the Axica, near the Brandenburgertor which delegates apparently enjoyed very much.

near the Brandenburgertor which delegates apparently enjoyed very much.

|

The next conference will take place in the Don Carlos resort near Malaga (Marbella) from 28th to 31st May 2016.

The organisation and venue will draw on the success of the Berlin

event and offer a large conference room with daylight and a sea view, a

very large exhibition room which will be able to host coffee breaks and

lunches and the possibility to exhibit vehicles both indoor and

outdoor. The theme of the conference will focus on our customers, be it

banks or retailers, small and large, and how they manage cash or deal

with consumer behaviour in payments. Don Carlos resort

ECB News

ESTA comments on the Eurosystem CIT Report

The ECB has recently conducted a comprehensive review of CIT sector which consists of over 170 interviews at EU and Eurozone country level, targeting the CIT/CMC industry, the banking sector and retailers. The study analyses the way in which the cash management industry works: the report identifies challenges, key trends common to the Euro area of the CIT/CMC sector and general trends in the cash cycle common to the euro area. Based on the comprehensive and close to exhaustive review of the sector, the ECB study makes a number of accurate observations and analysis on current and future drivers of the industry on which it has asked for ESTA’s views. The main report remains confidential, however an abridge version was shared with ESTA.

The ECB points out that most CIT markets in Europe are undergoing a consolidation process with increasing concentration, sometimes leading to duopolies or even monopolies. The ECB accurately analyses the reasons behind this trend, due to low margins, economies of scales and a high level of saturation of the market. ESTA’s views however go a few steps beyond these observations: even with a high level of concentration – and paradoxically also in cases of monopolies - the market remains extremely competitive since the market power belongs to the customers, not the supplier. Precisely because of that, consortia put in place in some countries by large customers may be more competition sensitive.

The evolution of the market from a mere CIT to a cash management industry will alter substantially the market structure and the nature of competition between operator, focusing more on added value to customers than mere price competition as is the case of the CIT industry.

The ECB report also flags the low level of cross border trade in the sector, thought it considers that the Cross Border CIT regulation is not at stake. ESTA agrees with this view as there are very few cross border needs, particularly since the CIT regulation excludes inter-NCB activities.

The ECB highlights that the Payment Services Directive (PSD) plays a potentially increasing role in the CMC/CIT sector, although it accurately flags that only one operator in one EU Member State so far has crossed the Rubicon of obtaining the status of payment services provider (PSP). ESTA comments that the PSD is a framework which, as such, is not fully suited for the industry: the PSD does not provide for a harmonised framework for CIT companies to move in that direction, so that the regulatory environment and prudential rules to be applied remain uncertain (not least the level of capital requirement required for obtaining the status of PSP), whilst no “European Passport” would be available for companies registering as PSP. ESTA would support the development of an optional scheme under the PSD, or a different framework, that would allow CMC operators that so wish to exploit the potential of this regulatory environment.

With regard to fraud/security and risk the ECB acknowledges the improving risk environment in which the industry operates and the effectiveness of measures adopted by the industry. This trend is confirmed by the latest data from ESTA’s 2014 Attack and Loss presentation during the annual conference in Berlin (see separate report in this Newsletter). As a follow up to the debate during ESTA 2014 annual conference in Athens in 2014 and the specific focus given to that issue to the insurance panel during the last Conference, ESTA has adopted a White Paper on internal Fraud, which identifies potential risk situations and relevant remedies. ESTA is confident that this White Paper, for which distribution is restricted due to its sensitivity, will provide assurance that the matter is adequately addressed.

As to Anti-Money Laundering (AML) the ECB questions the lack of obligations applying to CIT/CMC under the anti-money laundering directive. Today there are none at EU level that applies specifically to CIT/CMCs operations (unless they obtain a payment service provider status), however this does not mean that the industry is operating in a vacuum: the vast majority of our customers are subject to specific obligations with regards to money laundering. In addition, ESTA’s Members do conduct Know Your Customer procedures and would report any suspicious operations.

The relevant documents are not to be made public but Members who are interested may ask for them to the Secretariat contact@esta.biz.

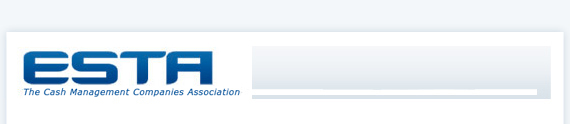

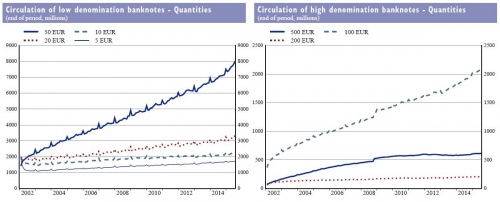

Cash in circulation (ECB)

This is the latest information published by the European Central Bank showing cash in circulation.

The total number of Euro banknotes in circulation at the end of Q2 2015

stood at 17,861 million, with a value of €1041.0 billion, an increase of

3,4% in their quantity and an increase of 2,46% in value compared to Q1

2015.

The total number of Euro coins in circulation at the end of Q2 2015

increased from 111,565 million of Q1 to 113,299 million, while their

value rose from €24,946 million to €25,400 million, ie an increase of

1.5% and 1.8% respectively since Q1 2015.

Click on graph to access detailed information on low and high denomination banknotes and coins.

ESTA’s annual presentation on Attack and Loss 2014

A standard and highly appreciated feature of the Annual Conference is the Annual Attack and Loss report, based on data sent by our members. This year’s report was presented by Clive O’Flynn, from Brink’s, the new chair of ESTA’s Security and Risk Group who has taken over the challenging task of following 10 years of Tony Smillie (G4S) in that function.

As usual, there were good news and bad news in the report. The good news is that the downwards trends in the number of attacks has continued with an all-time low of 373 attacks in 33 countries (a reduction of 22% compared to 2013 and roughly comparable to the - 24% between 2013/2012 in 2014 compared to 2013). The main share of the decrease is accounted for in the UK, France Sweden and Ireland. With regards to the type of attacks, the main reduction was achieved in cross pavement and customer premises. Some countries, such as Greece, have however seen an increase in the number of attacks.

The other good news is that the loss subsequent to these attacks has also continued to decrease at an also all time low, with a subsequent decrease of 17% compared to the previous year. Main reduction in losses occurred in Italy, even if this country remains the country with the highest loss. If losses increased in a few countries (Germany or Sweden), the overall level remain relatively low.

Further good news is to be to be found in the continued high share in the number of failed attacks continues in 2014: the very good achievement of 2013 (where the number of failed attacks increase very sharply compared to 2012) has been maintained in 2014: one in three attacks is bound to fail. Of note is that four countries (Hungary, Luxembourg, Norway and Serbia) experienced some attacks but suffered no loss at all.

The bad news remains however that the industry still operates in a violent environment, with continued use of explosives and in some case the use of military grade weapons.

The presentation this year included real case studies, with some impressive video footage of attacks, which were highly appreciated by the audience. The sessions also included case studues from the US and from Russia.

ESTA once again thanks those who actively contributed to the

compilation of these statistics, which are unique and very valuable in

understanding the risk environment in which the industry and our

customers operate.

A further reduction in the use of cash in France

By a decree of June from the Minister of Finance, France has further reduced the maximum amount that can be paid in cash. The previous amount was €3,000 and is now, since 1st of September, as low as €1,000, one of the lowest put in place in the EU (12 Member States have put in place cash payment limitation ranging from €999.99 to 15.000). The measure was introduced on grounds of curbing illicit financing.

ESTA supports the fight against illicit financing but has expressed concerns to the French authorities that the measure may impact primarily on legal activities, much more than illegal ones.

First, the measure may affect the confidence and trust in cash. The financial crisis has shown the preference of consumers for cash and mistrust in dematerialised payment instruments. Most likely, the measure will not only affect payments in cash above the €1,000 euros limit, but also those below that limit. Consumption is the most important component of GDP and in times where the objective of the Government economic policy is to boost growth and employment, public policies should rather be to stimulate, not restrict payments in cash, which is the most used means of payment.

There is no convincing evidence that the measure will deliver on its objectives in terms of curbing illegal activities. One only needs to look at cybercrime and the level of card fraud to realise that criminals do not need cash to make illicit profits. Nothing further prevents illegal activities’ cash proceedings to be broken down in slices of less than €1,000 to remains below the limit anyway. And for major organised crime activities, the main issue is not so much cash, but the very large amount of money to be laundered.

Maybe the fact that the measure does not apply to tourists in France is an admission that it is likely to reduce their level of expenditure. ESTA fully shares the views that such a measure is rather “a reflection of the inability of the authorities to tackle a problem than a solution or a response to the problem”[1]

[1] J. Dario Negueruela “Cash and the financial crisis”, International Cash Conference 2014, Bundesbank, 16 September 2016.

Internal News

New Adherent Member - Cash Logistik Security AG, from Düsseldorf, Germany www.cls.ag

Rond Point Schuman 6 - B5, Brussels, 1040, Belgium

Tel: +32(0)2 234 78 20

www.esta-cash.eu, contact@esta-cash.eu