Back from the 2010 conference in Porto

We were privy to twenty excellent presentations on a wide range of cash

related topics covering the cash cycle, the strategies of central

bankers and important security and insurance issues.

Our exhibitors and sponsors really pulled out all the stops to provide an effective and memorable conference for us to enjoy.

We can agree that we had an excellent conference in a wonderful

location; the hotel, weather and the people in Porto were all truly

excellent!

Most presentations delivered in Porto are available from our

web site.

Save the date of the 2011 conference: 22/24 May in Palma de Majorque (Spain)

Update on EU regulations

Professional cross-border transportation of euro cash by road between euro-area Member States.

The European Commission has published its communication documents in

July and it is now up to the members of the European Parliament and

Council to review the documents, possibly agree on possible amendments

and ratify the drafted regulation.

The regulation will be binding as soon as ratified and a 6 months

transitional period is provided to allow CIT operators willing to

operate cross border, to apply for the community license.

Mrs. Sophie Auconie, a French Member of the European Parliament, has

been appointed to chair a dedicated Committee entrusted with the review

of the drafted regulation.

ESTA updated Position Paper is now posted on our web site.

ECB decision on authenticity and fitness checking and recirculation of euro banknotes

You will find herewith copy of the

ECB decision with regard to Council Regulation 1338/2001 (amended by 44/2009 of 18 December 2008).

A few words have been changed:

- Recycling is replaced by recirculation

- PCHs are replaced by cash handlers to include retailers and casinos

You will note that this decision shall enter into force from January 1,

2011 and that each NCB can offer a transitional period of one year for

reporting and application.

Cash in circulation (ECB)

The latest data received from the European Central Bank shows that euro coins continue to grow:

The number of Euro banknotes in circulation at the end of Q1 2010 stood

at 13169 million, with a value of €797 billion, a decline of 3,47%,

respectively 1,11% since Q4 2009 and viewed between Q1 and Q2, a decline

of 2,55%, whereas the value increased by 1,88%.

In Q1 of this year, the total number of Euro coins in circulation grew

to 88302 million, while their value declined to €21305 million, a slight

decrease since Q4 2009. Comparing Q1 with Q2, the ECB information shows

an increase in quantity during the first half of 2010, whereby the

total number of Euro coins in circulation grew by 1,85% and their value

rose by 1,81%.

The trend shows an increase in numbers during 2010, with the exception

of the decrease of numbers for the low denomination banknotes in

circulation.

These are the graphs:

|

Chart 1:

Low denomination banknotes in circulation

(in quantities, millions)

|

|

Chart 2:

High denomination banknotes in circulation

(in quantities, millions)

|

|

Chart 3:

Low denomination coins in circulation

(in quantities, millions)

|

|

Chart 4:

High denomination coins in circulation

(in quantities, millions)

|

OLAF/ECB/EPC/ESTA conference

“Reinforcing the protection of the euro: a shared responsibility”

Thursday 28 and Friday 29 October 2010

ESTA members are invited to participate in the

conference, which will bring together experts from the European

Institutions, the banking sector and the cash-in-transit industry to

discuss cutting-edge issues in the protection of Europe’s single

currency.

The participation to the conference is free of charges. Interpretation will be provided in English, French and German.

Please download your formal invitation and conference agenda and if interested confirm back to francis.ravez@esta.biz before October 18th!

CEN TC 263 WG4

CEN TC 263 WG4 - standardization process of cash degradation system.

The Plenary session of October 6th has decided to abandon the current work item, as requested by both ESTA and Euricpa.

Miscellaneous

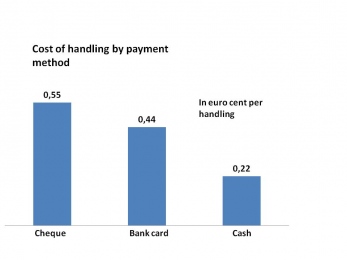

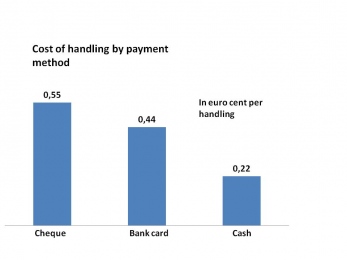

Compared cost of payments (FCD)

The French “Fédération du Commerce et de la Distribution” (FCD) has

established stats on the average cost of handling various method of

payments, showing cash payment being the less expensive method.

Source: FCD

Cashless payments growth rate slow

Last month the European Central Bank (ECB) published the 2009 statistics

on payments, which gives comprehensive data on cashless payment

transaction volumes and values in the 27 Member States of the EU.

The ECB statistics on payments show that:

- The number of cashless payments in the EU grew by 3.3 billion

in 2009 to almost 83 billion transactions. This represented a 4,2%

increase, similar growth as previous year but much slower than the

Compound Annual Growth Rate of 6,1% between 2000 and 2008.

- The corresponding total value of cashless payments in the EU

decreased by almost 16% to €227 trillion, resulting in a further decline

– of almost 20% – in the average value per transaction, to €2,771.

- 93% of cashless payments were performed in the 15 Western

European countries. On average, each person in the EU 27 performed 166

cashless payments in 2009, ranging from nine cashless payments per

person in Bulgaria (new EU member in 2007) to 332 in Finland.

The growth rate of the cashless payments volume in the EU is slower than

anticipated. However many European countries were hit by the financial

crisis and this is surely to be considered a reason for the recent

slowdown. As economic conditions improve we are likely to see a return

to the higher growth rates in 2010.

Source: RBR Bulletin October 2010

“Dirty money” myth dispelled

An International team, led by Ballarat University has found that

banknotes are not as contaminated with dangerous levels of bacteria as

suspected.

Having analysed a number of 1280 banknotes collected from food outlets

from at least ten nations, lead researcher Dr Frank Vriesekoop concludes

that there were no alarming levels of pathogenic bacteria found on

money anywhere in the world.

However, Dr Vriesekoop has found that richer and more developed

countries had fewer bacteria on their money than poorer countries and

that the age and material of the note affect the extent of contamination

of that money. Notes made from polymer material carried significantly

less bacteria compared to the notes based on cotton.

Still, researchers recommended that in food outlets the handling of food

and the collection and exchange of money be physically separated,

preferably undertaken by different people.

Source: rediff Business August 13, 2010

Financial inclusion – the role of payments (EFFI)

Europe must maintain the right for citizens to use the means of payment

of their choice, including cash, European Politicians and NGOs say.

More and more, Europeans complain that they are finding it difficult to

access to cash or to be able to use it to pay for every day goods and

services.

During a roundtable debate organised by the European Foundation for

Financial Inclusion (EFFI), politicians and NGOs expressed fear that

current efforts in several European countries to favour the use of

credit or debit cards and electronic payments will leave many people by

the wayside, and thus financially “excluded.”

“If we start by saying that 2 out of 10 European citizens do not have

access to a bank account, then are starting to have an idea of the

capacity to harm and affect social inclusion,” said MEP Peter Skinner,

who hosted a roundtable discussion on October 6th entitled “Maintaining

freedom in choice of payments: a contribution to the battle against

social exclusion.”

The Foundation considers that the free choice of payments is a basic

right for EU citizens and consumers, in particular for the more

vulnerable members of society – the young, the aged, migrants and the

unemployed, among others. “This is an issue about civil liberties,

about who is included and who is excluded,” said MEP Jean Lambert.

NGOs such as the European Anti-Poverty Network and the European

Consumers’ Organisation BEUC likewise voiced their concern. A means of

payment is no ordinary good or service, said BEUC’s Anne Fily, “it

should be available to anyone as a kind of public service.”

For more information, please visit

www.euffi.org

Source:

The Parliament Magazine