ESTA Conference, Exhibition & General Assembly

2-4 June, 2013, Marseille, France

The Strengths of Cash: Accessible and Universal

The next ESTA conference is taking place in Marseille, at the Mercure

Centre Hotel. We expect this to be a popular destination, so please

reserve your place at the conference early to avoid disappointment.

The number of conference places is limited, and your place is only secure once you have paid. Reservations will open on the

ESTA website by the end of November 2012.

We have a limited number of rooms at a specially negotiated price at the

Mercure Centre Hotel,

so book early to have the most convenient location in sunny Marseille,

which also happens to be European cultural capital for 2013.

We also have rooms at negotiated prices at the following Accor hotels:

Sofitel Vieux Port Marseille, Novotel Vieux Port and MGallery Beauvau

Hotel.

European Central Bank News

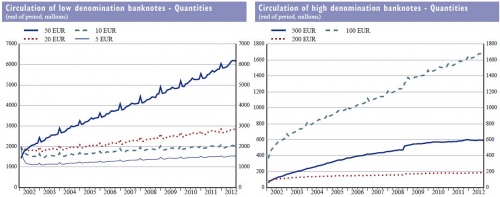

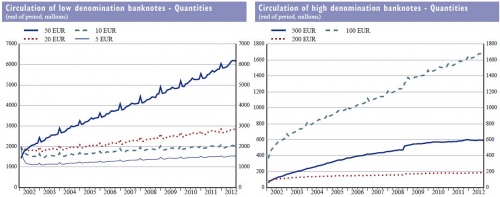

Cash in circulation (ECB)

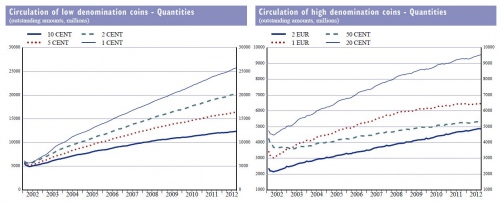

The latest information published by the European Central Bank shows that cash continues to grow:

The number of Euro notes in circulation at the end of Q3 2012 stood at

14,980 million, with a value of €892.5 billion, a slight drop of 0.12%

in volume, and a drop of 0.13% in value since Q2 2012. Viewed between Q1

and Q2, there was an increase of 4% in volume and a 2.7% in value.

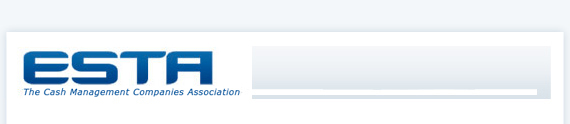

In Q3 the total number of Euro coins in circulation grew to 101,072

million, while their value rose to €23,465 million, an increase of 1.25%

and 0.6% respectively since Q2 2012. The increase during the first half

of 2012 was slightly higher than Q3. The total number of Euro coins in

circulation grew by 1.5% and their value rose by 1.3% comparing Q1 with

Q2. The trend shows a general increase in numbers during 2012 with the

largest growth in Q2.

Click on graph to access detailed info on the low and high denomination euro coins.

Source: Cash in circulation (ECB)

The Cost of Making a Payment in the EU - ECB study shows cash is cheapest

A new study examining the cost of making a payment in the EU was

released by the European Central Bank in September of this year.

Thirteen national central banks participated in the study, which showed

that the cost of payments amounts to around 45 billion € or 1% of their

combined GDP. The prize for lowest unit cost in a majority of countries

went to cash, however in five of the 13 countries, the debit card comes

out cheapest. The ECB would not disclose which countries, but these are

most likely Nordic states. Cash payments amount to almost half of the

total costs, and have the lowest unit social cost, with the next least

expensive payment means being the debit card. Cash is still the most

frequently used payment instrument with 69% of transactions in the

sample countries made in cash, and 65% of all transactions in the EU 27

made in cash (figures for 2009).

Communication formats for cash transactions between National Central Banks and Professional Clients

A new system named DCES, Data Exchange for Cash Services, was launched

by the European Central Bank in October. The DCES is an interface,

hosted by the ECB, which translates between different Central Bank

communication standards. It allows banks and CIT companies to place cash

orders and notify cash lodgments to any non-domestic Central Bank via

their domestic Central Bank's local cash application.

The integration of the DCES interface with the Central Banks' domestic

cash applications has been tested successfully, and since the beginning

of October, in nine EU member states the system has been able to

exchange transaction messages from professional clients in case a bank

or CIT company wishes to withdraw or lodge cash, from or to, a

non-domestic Central Bank.

Countries operating the DCES in this first wave of implementation are:

Belgium, Denmark, Ireland, Cyprus, Luxembourg, Malta, the Netherlands,

Austria, and Finland.

European Commission, Parliament and Regulatory Developments

EC Impact Assessment on the continued issuance of 1 and 2 euro cent coins

The European Parliament has requested that the European Commission

Directorate General of Economic and Financial Affairs conduct an impact

assessment on the continued use of 1 and 2 euro cent coins. The study

will include a cost-benefit analysis taking into account the real

production costs of the coins set against their value and benefits.

These smallest denominations of coins account for 45.5% of the total

number of coins in circulation and represent 2.8% of the value of the

coins in circulation.

European

stakeholders have been asked to submit their views and ESTA has

participated by collating data from our members. ESTA members anticipate

that the cessation of 1 and 2 cent coins would have little impact on

their businesses. We expect the results of the impact assessment in the

coming months.

Cross-Border Regulation Reminder

The EU Regulation on cross-border transport of euro cash by road between

euro-area member states will be binding from December 1, 2012. These

are just a few facts you need to be aware of if you engage in

transporting euro cash to countries other than your own.

1. If you wish to transport or continue to transport euros to other

European countries having adopted the Euro, you need to apply for a

Community License from your national licensing authority, which is

valid for 5 years.

2. You no longer need an international haulage license for cross border euro transport.

3. Your national wages may not apply if you conduct cross-border

transport. The highest wage of all countries visited will apply to your

team.

4. Other currencies may be transported with the euros, up to 20% of the total.

5. Check with your authorities that they have informed the European

Commission of the secure methods of cross-border transport of euro cash.

Be sure that this method is acceptable as you may face unfair

competition from cross-border operators.

6. Extra training may be necessary for your teams. The EU has specified a

training programme that you may already cover, and which need not be

repeated. Arms licenses from the destination or transit country may also

be necessary. You will need to read the whole document to be fully

informed

www.esta-cash.eu/en/publications/

European Commission Green Paper adopted by European Parliament

The European Commission's 'Towards an integrated European market for

card, internet and mobile payments' report was adopted by the European

Parliament's ECON Committee this month. The European Parliament (EP) is

not satisfied with the current lack of transparency in payment costs.

The EP believes Multiple Interchange Fees are too high, and some MEPs

tried to have them banned but were voted down. The ECON Committee is

disappointed that the paper doesn’t address the comparative costs and

societal impacts of cash or cheque payments in comparison with card,

internet and mobile payments.

Click to read the report

The Electronic Payments Lobby

The Cash-Lite Society – the Better than Cash Alliance

This study was written by Bankable Frontier Associates, a consulting

firm promoting financial inclusion for the poor through a shift to

electronic payments. Published by the “Better than Cash Alliance”, the

study’s aim is to promote a deliberate and strategic shift toward

electronic payments through bulk payers: governments, the private sector

and the development aid sector. Members of the Better than Cash

Alliance include the Bill and Melinda Gates Foundation, Citi Bank, the

Ford Foundation and VISA. Their idea is to push governments of

developing nations to have a clear policy route to more electronic

payments, leading to a “cash lite” system. The authors admit that an

imminent cashless society is, however, unrealistic, and that what we are

really likely to see is a drift toward lower cash use. They accept

that electronic payments will have to co-exist with cash. What the

authors of the study don’t address is discrimination against the

marginalized poor who need to use cash as they are unbanked. The benefit

of increasing availability of cash to the poor is ignored. The authors

don’t examine how cash and electronic payments can cohabit effectively,

which weakens its impact, as this is the reality across the world.

Click to read the study

Supplier News

EURICPA Releases its Stained Notes Handling Recommendations

During September, EURICPA, the European Intelligent Cash Protection Association,

released

its recommendations on stained notes handling. Contributors to the

paper include Oberthur, Gehrer, Spinnaker, Villiger Security Solutions,

SQS Security Qube System and 3SI Security Systems. The paper has

specialized safety instructions for CIT companies following an ink

activation.

Click to read the paper

Fraud and Hacking

Global Card Fraud on the Rise shows Survey

A global study of more than 5,200 consumers across 17 countries

conducted by ACI Worldwide and the Aite Group, revealed that one in four

surveyed has been victimized by credit, debit or pre-paid card fraud

during the past five years. When people experience fraud around 21%

change their card provider. Of those getting a replacement card, 46% use

it less than the original card and more than 50% of fraud victims also

start using more cash.

Click to read the study

Smartphone Fraud Hacking

Two researchers from the

Intrepidus Group

have exploited the vulnerabilities of NFC (near field communication) in

smart phones. Corey Benninger and Max Sobell created an application

that takes advantage of a weakness in NFC-based subway cards that lets

users replenish their fare card balance for free. They announced their

discovery at the EUSecWest security conference in Amsterdam in September

this year. They had already alerted San Francisco and New Jersey

authorities in 2011, who were the subjects in their app experiment, and

point out that other cities have weaknesses in their systems also. The

implication of this research is that it indicates how just how quickly

and easily a criminal and fraudulent system can be developed. It is yet

another example showing how weak the security of mobile phone payments

can be.

Retail Research

RBR Report on the future of self-checkout

The Retail Banking Research Group

has published a report on self-checkouts which shows that this sector

sold seven times more terminals in 2011 than were sold a decade earlier.

A total of 26, 700 terminals were sold in 2011 and RBR forecasts that

by 2017, annual shipment numbers will be around 60, 000. North America

has replaced Western Europe as the largest region for self-checkout

shipments in 2011, making up 41% of the total. The first self-checkouts

in the Arab world were set up in Saudi Arabia. There has been more

interest in self-checkouts in Poland, the Czech Republic and Russia.

Upcoming Conferences

ICCOS - EMEA event in Warsaw, Poland November 5-7 2012.

The number of conference places is limited, and your place is only secure once you have paid. Reservations will open on the

The number of conference places is limited, and your place is only secure once you have paid. Reservations will open on the

European

stakeholders have been asked to submit their views and ESTA has

participated by collating data from our members. ESTA members anticipate

that the cessation of 1 and 2 cent coins would have little impact on

their businesses. We expect the results of the impact assessment in the

coming months.

European

stakeholders have been asked to submit their views and ESTA has

participated by collating data from our members. ESTA members anticipate

that the cessation of 1 and 2 cent coins would have little impact on

their businesses. We expect the results of the impact assessment in the

coming months. released

its recommendations on stained notes handling. Contributors to the

paper include Oberthur, Gehrer, Spinnaker, Villiger Security Solutions,

SQS Security Qube System and 3SI Security Systems. The paper has

specialized safety instructions for CIT companies following an ink

activation.

released

its recommendations on stained notes handling. Contributors to the

paper include Oberthur, Gehrer, Spinnaker, Villiger Security Solutions,

SQS Security Qube System and 3SI Security Systems. The paper has

specialized safety instructions for CIT companies following an ink

activation.