|

| :: December 2011 | Newsletter no 66 :: |

|

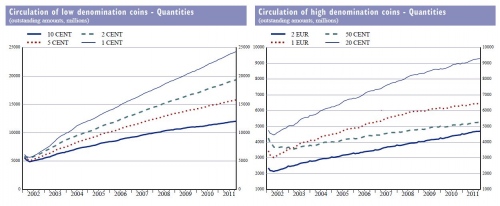

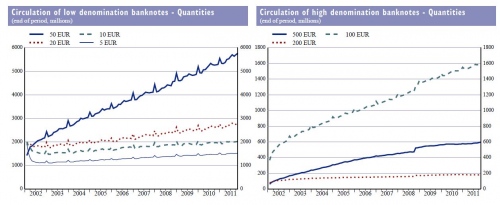

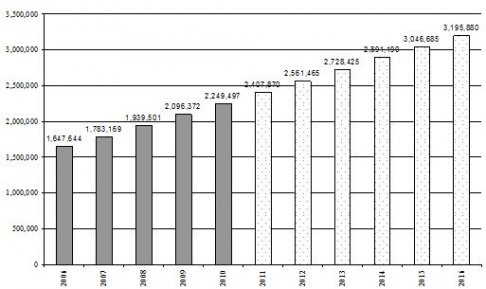

Dear Readers, Dear Readers,Before handing over the latest issue of our Newsletter, I would like to take this opportunity to thank you for your good cooperation during last year and all fruitful discussions we had. Every achievement we had during 2011 is the outcome of hard work and numerous meetings of our Working Groups sharing their expert knowledge with the association. The success has been of benefit to the whole CIT industry. Furthermore, we have strengthened relations with the European institutions and with important stakeholders in Brussels. ESTA membership is continuously growing, and ESTA today counts 145 members out of which 77 are effective, 56 adherent, 8 associate and 4 corresponding. I am looking forward to working with you again next year and believe that there will be plenty of challenges. Let me wish you a Merry Christmas and a prosperous & happy New Year 2012! Francis Ravez, ESTA Secretary General ESTA Annual Conference 2012Next years’ conference will take place in the Sheraton Bratislava Hotel in Slovakia on 10-12 June.The ESTA Board of Directors is currently drawing up a two-day program to meet its members’ expectations of a high level business conference. The main topics on next years’ agenda are; European cash cycle models, EU legislation challenging the CIT industry and security issues.  The online conference registration opens at the end of January on www.esta-cash.eu The exact date of the opening of the online registration will be announced by a separate mailling. The online conference registration opens at the end of January on www.esta-cash.eu The exact date of the opening of the online registration will be announced by a separate mailling.Bratislava stretches over both banks of the Danube River and at the foot of the mountains of Small Carpathians. The city is not only a place of history, culture, delicious gastronomy and wine but also a city where you can relax, do luxurious shopping and have a great time. There will obviously be a Partners’ Program organized! Let the ESTA conference be an opportunity to combine a city trip with the unique chance to meet business partners and to stay on top of industry topics. EU AffairsThe Cross Border regulationThe Cross Border Regulation has now been published in the Official Journal of the EU on November 29, 2011 and is immediately binding. The legislation provides for a one year transitional period. During the transitional period, the CIT companies wishing to operate cross border need to qualify and then apply to their national licensing authorities for a license. Remember that the Community license will be compulsory as of 29/11/2012 for those of you who want to transport euros in cash by road between member states whose currency is the euro.The Payment Services DirectiveThis Directive is coming up for review on November 1, 2012 and the European Commission has recently published its roadmap. In the roadmap, the Commission outlines the possibility of extending the scope of the Directive to the following: payment transactions not yet covered and to revise it in order to encompass low value payment instruments and electronic money.You will remember that cash was part of the negative scope of the Directive and not addressed, but the Commission is also considering reducing the number of payment transactions currently explicitly excluded from this Directive.. Once the review is finished, stakeholders and experts in the area of payments will be consulted on their proposals for changes. Cash in circulation (ECB)Latest information published by the European Central Bank shows that cash continues to grow:The number of Euro notes in circulation at the end of Q3 2011 stood at 14,314 million, with a value of €857.3 billion, an increase of 0,6%, respectively 1,2% since Q2 2011 and viewed between Q1 and Q2, an increase of 4,18% and 2,76% respectively. In Q3 the total number of Euro coins in circulation grew to 96,747 million, while their value rose to €22,894 million, a slight increase of 1,14% and 0,6% respectively since Q2 2011. The increase during the first half of 2011 was slightly higher, whereby the total number of Euro coins in circulation grew with 1,9% and their value rose with 1,86% comparing Q1 with Q2. The trend shows a general increase in numbers during 2011 with the largest growth in Q2.

Click on graph to access detailed information on the low and high denomination euro coins

. To access detailed information on the low and high denomination euro banknotes, click on graph

Internal AffairsNew ESTA members:VARNOST MARIBOR d.d., Slovenia LINK TOISM2, USA G4S Cash Solutions (South Africa) (Pty), South Africa New ESTA Office and phone numberESTA moved offices in October. Take note of the new address and phone number!Rond Point Schuman 6 - B5, Brussels, 1040, Belgium Tel: +32(0)2 234 78 20 E-mail and website addresses remain unchanged: francis.ravez@esta-cash.eu, contact@esta-cash.eu, www.esta-cash.eu Financial InclusionRetail Payment Services – The Citizen’s Right to Choose?On 8 November 2011 the European Foundation for Financial Inclusion (EUFFI) held a breakfast roundtable in the European Parliament in Brussels entitled ‘Retail Payment Services in the EU - the Citizen’s right to choose?’Jim Murray, former Director of the European Consumers Organisation and moderator of the discussion, highlighted the issue of financial inclusion in Europe, explaining that a large number of EU citizens are not able to fully participate in society due to denied or restricted access to financial services, and that the lack of access to financial services penalises in particular the poor and elderly. Mr Farid Aliyev of BEUC, the European Consumers’ Association stated that, “Cash is one choice among many, and is especially important for financially excluded people. That’s why we don’t see any good reason for phasing out cash. There is no viable alternative to cash which is available to all consumers, “ Miriam Harkin, MEP said that in the EU the availability of essential payment services is neither ensured by payment service providers nor guaranteed by all EU member states. This raises serious concerns about financial inclusion in Europe, which urgently needs to be addressed. Mr Rüdiger Voss (DG ECFIN, European Commission) explained that while the number of means of payment is increasing, that is, cash, debit cards, proton, and credit cards, the worrying tendency in the euro zone is towards a cashless economy. DG ECFIN is looking into the protection of the euro currency, although legislating is difficult. Representatives of the European Consumers’ Organisation and Age Platform Europe pushed for recognition of the need for universal bank accounts and easy access to financial services for all. Jim Murray concluded the discussion saying that there is a need to tackle issues on retail payment in the European Parliament and for more focus on the real needs of people in future EU policy-making. In the newsEURICPA organised the first European conference on stained banknotes EURICPA (European Intelligent Cash Protection Association)

held the first European conference on “the stained banknote cycle” in

Brussels on Tuesday 8 November 2011. Criminal attempts to recycle

stained banknotes require a response in the entire communication and

security system for the transport and storage of cash in Europe. In a

bid to boost communication on stained banknotes, in November 2011 the

European Commission launched a communication campaign on the theme of “a

stained banknote is probably a stolen banknote”. The efforts of

European police forces to combat organized crime and attempts to

circulate banknotes stolen in other member states rely on the ability to

identify any stained stolen banknotes recovered. The introduction of a

European database of ink dyes and stained banknotes, developed by the

French Institut National de Police Scientifique (INPS) in collaboration

with the European Network of Forensic Science Institutes (ENFSI), is a

major step in this direction. EURICPA (European Intelligent Cash Protection Association)

held the first European conference on “the stained banknote cycle” in

Brussels on Tuesday 8 November 2011. Criminal attempts to recycle

stained banknotes require a response in the entire communication and

security system for the transport and storage of cash in Europe. In a

bid to boost communication on stained banknotes, in November 2011 the

European Commission launched a communication campaign on the theme of “a

stained banknote is probably a stolen banknote”. The efforts of

European police forces to combat organized crime and attempts to

circulate banknotes stolen in other member states rely on the ability to

identify any stained stolen banknotes recovered. The introduction of a

European database of ink dyes and stained banknotes, developed by the

French Institut National de Police Scientifique (INPS) in collaboration

with the European Network of Forensic Science Institutes (ENFSI), is a

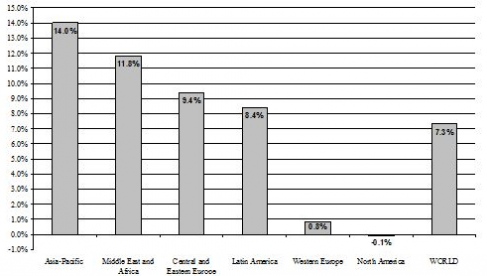

major step in this direction. Automatic Teller Machine (ATM) Market booms in the Asia-PacificRapid growth in demand for new ATMs in the Asia-Pacific and Latin American markets is offsetting a decline the mature markets of the US and Europe, says Retail Banking Research, (RBR) , a London-based research and consulting company.Growth in the number of ATMs in 2010, by Region  Deployers in the Asia-Pacific installed over 100, 000 new ATMs in 2010, the highest ever figure for any region. Half of this growth came from China, where installers were motivated by a 50 % increase in the volume of cash withdrawals. Another 30% came from India, Indonesia, South Korea and Thailand. In Latin America, Brazil amounted to two thirds of the region’s new installations, deployed by only two major players: Banco do Brasil and TecBan. Number of ATMs 2006-2016  Strong demand for ATM cash withdrawals will remain one of the major drivers of ATM growth for the future. RBR expects the global installed base of ATMs to increase by 42%, to 3.2 million terminals by 2016. The ATM markets of the Asia-Pacific, Central and Eastern Europe and the Middle East and Africa are predicted by RBR to expand significantly faster than other regions. They are also anticipating higher growth in ATM cash withdrawals, expecting them to double between 2010 and 2016. RBR has just published a full study, “Global ATM Market and Forecasts to 2016”. |

|

ESTA - European Security Transport Association Rond Point Schuman 6 - B5, Brussels, 1040, Belgium Tel: +32(0)2 234 78 20 www.esta-cash.eu, contact@esta-cash.eu |