Dear Readers,

I am pleased to say we had an extremely successful annual conference

this year in Bratislava, which saw speakers joining us from all over the

world. They addressed the whole gamut of cash questions: transport

issues, retailers' needs, the central banks and their infrastructure, as

well as cross border licencing. You will find the presentations given

at the conference on our website on the

events page.

Our Conclusion from the ESTA Conference: Cash is alive and kicking

Central Banks

- The cash playing field is a fast-changing environment, and

the ECB wants to see professional, reliable, efficient and competitive

companies as its partners.

- The French Central Bank is reshaping its infrastructure, and is

seeing increased partnership with CIT companies. A Balance Sheet Relief

Scheme is seen as necessary to trigger recirculation.

- The Central Bank of Norway has divided responsibility for cash

processing between all stakeholders which is promoting better

efficiency.

- The Belgian Central Bank has identified a model offering shared facilities to CIT and Balance Sheet Relief to the bankers.

Payments: Consumers and Retailers

- Retailers still believe cash to be cheaper for their operations

than cards. Cash remains an essential part of our economy especially for

the underprivileged and financially excluded. For them, cards are not

meeting their payment needs, and don't seem likely to in the near

future.

Banks and payment instruments

- Innovations in the ATM sector are offering new opportunities for CIT companies, such as recirculation and remittances.

Security

- IBNS has not proved to be a cure-all remedy against attacks, and

CIT companies need suppliers to research and produce more innovative

products.

- French law is being updated to cope with dramatically increasing

criminality. For this approach to be effective, it will require close

cooperation and partnership with CIT companies.

Country Updates

- The US and South African attack and loss statistics offer a stark contrast with figures from EU countries.

European Regulation

- The European Commission will review its recommendation on legal

tender. We advocate a binding directive to prevent discrimination

against cash in EU economies.

- If you want to transport cash across borders in the EU you must

request a cross border licence now, see below for our section,” Hard

facts about the EU Cross Border Regulation”.

Insurance

- The insurance market for 2011 is a benign loss environment with

plentiful capacity. Given these favourable conditions for insurers, we

would advocate lower premiums for CIT companies.

Attack and Loss

- The number of attacks against CIT services and premises is

decreasing; however, the losses are increasing. Governments need to be

pressured to place a higher priority on preventive action for protecting

our essential services.

Hard facts about the EU Cross Border Regulation

The EU Cross Border Regulation will be binding EU law from 30 November 2012.

This regulation only refers to euro cash being moved by road, between euro-area member states.

All CIT companies wishing to transport euro cash cross border from 30

November 2012 need to possess a valid cross border license that is

granted by your national licensing authorities.

Your national authorities need to be contacted to ensure they inform the

EU authorities, and CIT companies, of their choice of mode of transport

from the list provided in the regulation. CIT companies must make sure

that this choice does not have negative impacts on competition, security

or social conditions for workers.

Do not hesitate to contact us for clarification,

francis.ravez@esta.biz

Here is the text of the

Cross Border Regulation for your information.

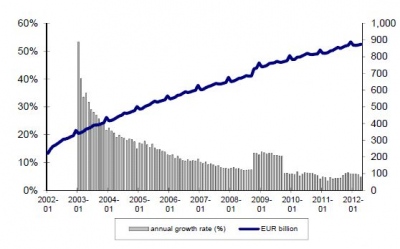

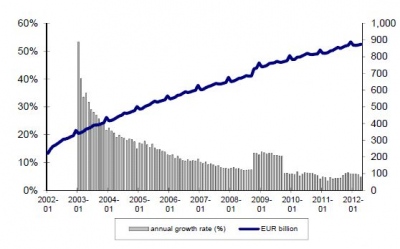

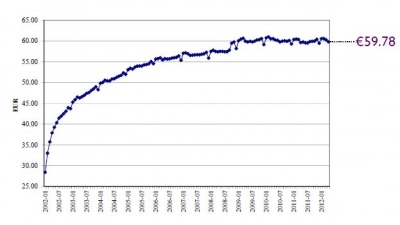

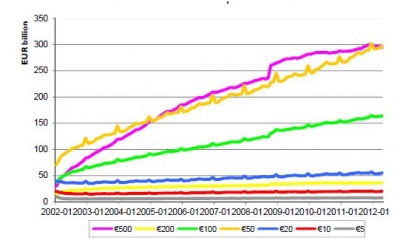

European Central Bank Data

The following graphs and information is provided to us by the European

Central Bank. By the end of April 2012, euro banknote circulation had

been increasing at an annual rate of 4.7% (value) and 4.4% (pieces). The

ECB stated that a huge part of the currency circulation is actually

being hoarded, and that up to 25% of the circulation value is outside

the euro area.

It further states that the number of euro banknote counterfeits is low

and that virtually all euro counterfeits can be recognized without any

technical equipment and within a few seconds. It emphasizes further that

no counterfeits are capable of fooling proper sensors in banknote

acceptors or sorting machines. All of the following graphs are sourced

from the European Central Bank.

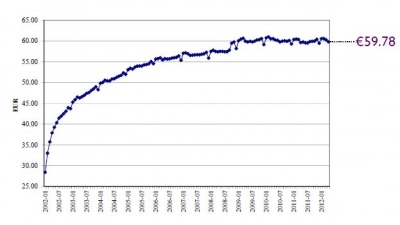

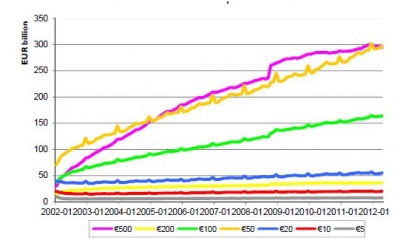

At the end of April 2012, 14.6 billion notes (equal to 874 billion euro) was in circulation, see graph below.

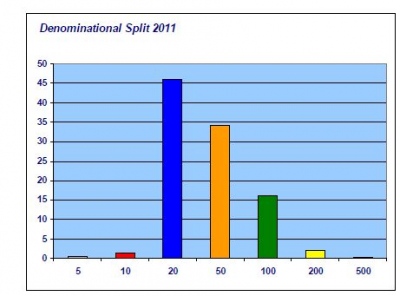

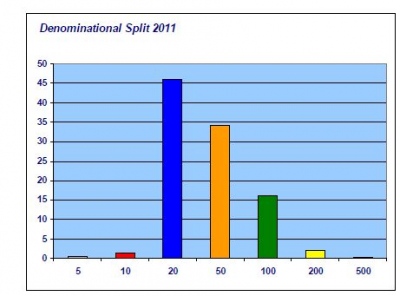

Regarding counterfeited notes, the ECB statistics show that 96% of all

counterfeits belong to the middle denominations of 20, 50 and 100 euro

notes. The ECB noted that the annual financial damage caused by

counterfeited euro banknotes passed in circulation has been stable

(30-40 million euros).

Circulation Development 1

Circulation Development 2

Circulation Development 3

Counterfeit Development Euro Notes

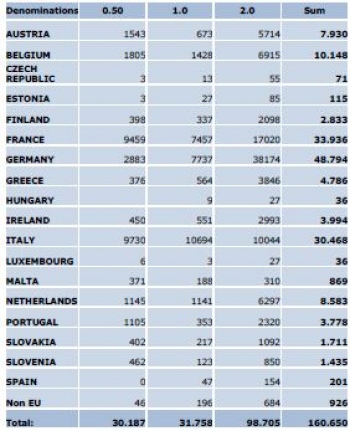

Counterfeits Development Euro Coins

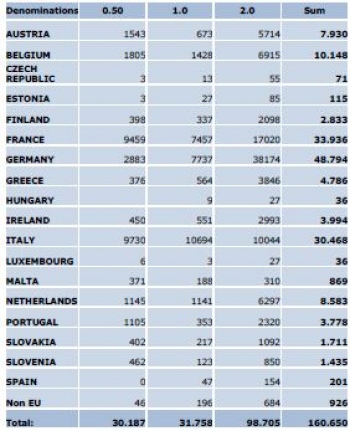

The table represents the status on euro coins counterfeiting as of 24

May 2012. This table is reproduced courtesy of OLAF, European

Commission. OLAF states that the number of counterfeit euro coins found

in circulation continued to drop and has remained well below 200 000

pieces per year, which results as one counterfeit coin for 100 000

genuine coins. OLAF goes on to say that vigilance is necessary as the

sophistication of the counterfeits has risen.

New Members

I would like to wish a warm welcome to our new members, and we were most

fortunate that they were almost all able to be with us at the

conference in Bratislava.

Effective Members Varnost Maribor – Slovenia

Associate Members Writer Safeguard Private – India

Adherent Members Feronyl – Belgium Griffin – USA

Virleo – UK CSS & Fireking International – USA Bode Panzer – Czech

Republic Romag – UK Saab – Sweden ISM2 – USA Applied DNA Sciences –

USA Sikkerhet & Forsegling – Norway

RBR Study: ATM Market in Central and Eastern Europe growing seven times faster than Western Europe

The Central and Eastern European (CEE) ATM market continued its recent

trend of strong and steady growth last year increasing by 10% in 2011.

Last year 18,000 new machines were installed in this area taking the

total to 208,000. The global recession had an impact, as has the

maturation of the market - in the mid-2000s the growth rate was 30% or

sometimes more, so the rate has in fact fallen. Even with this fall, the

level of growth is still seven times higher than in Western Europe.

These are the findings of a report published in May, 2012, by Retail

Banking Research, a London-based strategic research and consulting firm.

The report is titled “ATMs and Cash Dispensers Central and Eastern

Europe 2012” and covers 15 countries.

The growth of the ATM market in Russia is the highest – 83% of the

growth in the region as a whole came from Russia where 15,000 new ATMs

were installed, at an increase of 15%. Latvia's ATM base shrank by 13%

and a full 20% of Lithuania's ATMs were withdrawn after the bankruptcy

of Bankas Snoras, the country's third largest deployer. The new

market for ATMs which accept deposits was strong in 2011, with the

number of these machines rising by 37% to nearly 26,000 in the region.

Most are in Russia, the Ukraine, Kazakhstan, Poland and the Czech

Republic following. Even so, cash recyclers are rare with fewer than 500

installed in the whole region.

Security in the region is a growing market, and deployers have installed

security cameras at 73% of their ATMs to fight card fraud and deter

physical attacks. In Belarus 98% of terminals are equipped with security

cameras, while only Hungary, Slovenia and Croatia have fewer than 40%

of ATMs equipped.

Other statistics on security include: 96% of the region's ATMs are now

EMV-compliant, and 99% comply with 3DES security requirements. Over half

the ATMs have been fitted with anti-skimming devices, with Slovakia,

Russia and Croatia the most advanced markets. Banknote degradation in

now present in seven of the CEE markets and biometric identification has

been introduced by BPS Bank in Poland.

Upcoming Conferences

EFMA

EFMA is holding a conference and exhibition, ”The Future of Cash” on Tuesday 25 and Wednesday 26 September 2012.

EFMA

The venue: Hotel Concorde La Fayette 3, Place du Général Kœnig

75017 Paris, France Tél. +33 1 40 68 50 68 - Fax. +33 1 40 68 50 43

www.concorde-lafayette.com/en

ICCOS

The next ICCOS conference is taking place at the Hilton Hotel &

Convention Centre, Warsaw, Poland November 5-7, 2012. For more

information go to:

www.emea.iccos.com

ESTA Conference 2013

Mark the dates in your calendar now, our next conference will be from

2-4 June 2013. The venue will be sunny Marseille in southern France.

I wish to thank you again for your presence at our conference in

Bratislava, it is the good will and active participation of you, our

members, that makes the conference the unique success that it is.

Enjoy the summer vacation.